The 45-Second Trick For Clark Wealth Partners

9 Simple Techniques For Clark Wealth Partners

Table of ContentsThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutFascination About Clark Wealth PartnersFacts About Clark Wealth Partners RevealedThe Main Principles Of Clark Wealth Partners The Main Principles Of Clark Wealth Partners The Definitive Guide to Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.

These are experts who supply investment guidance and are registered with the SEC or their state's safety and securities regulator. Financial advisors can additionally specialize, such as in pupil loans, elderly requirements, tax obligations, insurance policy and various other aspects of your financial resources.Only economic experts whose classification needs a fiduciary dutylike licensed economic organizers, for instancecan say the very same. This distinction likewise indicates that fiduciary and financial expert charge frameworks vary also.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

If they are fee-only, they're extra likely to be a fiduciary. Numerous qualifications and classifications require a fiduciary obligation.

Picking a fiduciary will certainly ensure you aren't steered toward particular investments due to the commission they supply - financial company st louis. With lots of cash on the line, you might want a monetary specialist who is legally bound to make use of those funds carefully and only in your ideal passions. Non-fiduciaries may recommend financial investment items that are best for their pocketbooks and not your investing objectives

The Only Guide to Clark Wealth Partners

Boost in savings the typical family saw that worked with an economic consultant for 15 years or even more compared to a comparable house without a monetary expert. "Much more on the Worth of Financial Advisors," CIRANO Project Information 2020rp-04, CIRANO.

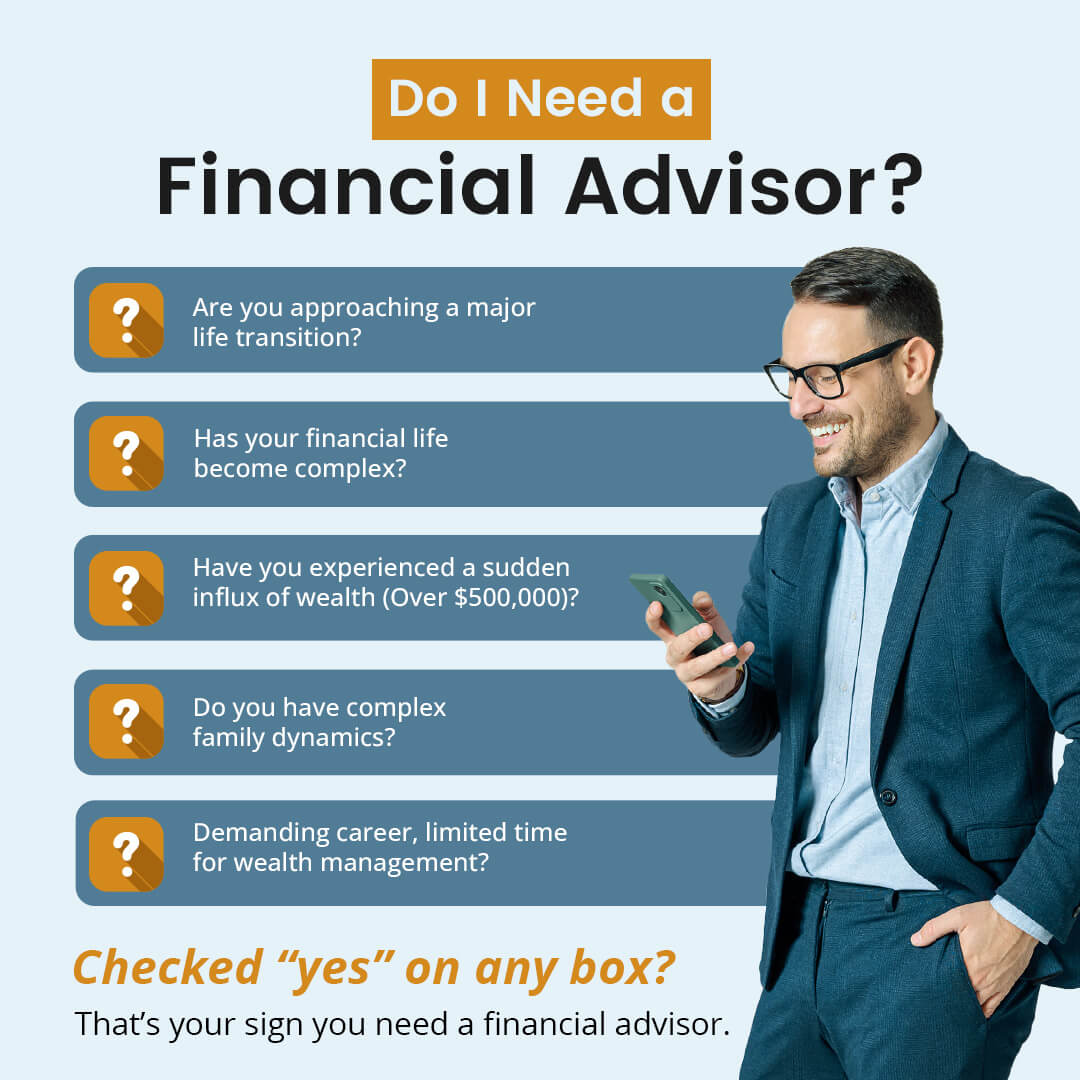

Financial guidance can be valuable at turning factors in your life. Like when you're beginning a family, being retrenched, intending for retirement or handling an inheritance. When you consult with an adviser for the first time, exercise what you desire to obtain from the advice. Before they make any type of referrals, an advisor must put in the time to discuss what is essential to you.

Examine This Report on Clark Wealth Partners

Once you have actually concurred to go in advance, your monetary adviser will certainly prepare a monetary plan for you. You should constantly really feel comfortable with your advisor and their advice.

Urge that you are notified of all purchases, and that you get all communication relevant to the account. Your adviser might suggest a taken care of discretionary account (MDA) as a means of managing your financial investments. This entails authorizing a contract (MDA agreement) so they can see this page buy or market investments without needing to contact you.

Get This Report on Clark Wealth Partners

To protect your money: Don't give your consultant power of attorney. Urge all document about your investments are sent out to you, not simply your adviser.

If you're moving to a new advisor, you'll need to arrange to move your monetary records to them. If you need assistance, ask your advisor to discuss the procedure.

will retire over the following decade. To load their footwear, the nation will require even more than 100,000 new monetary advisors to enter the sector. In their daily work, financial experts take care of both technical and creative jobs. United State News and Globe Record ranked the duty among the top 20 Best Organization Jobs.

What Does Clark Wealth Partners Mean?

Assisting people attain their economic objectives is a financial advisor's main feature. But they are also a local business proprietor, and a section of their time is committed to handling their branch office. As the leader of their practice, Edward Jones monetary experts need the leadership skills to employ and take care of personnel, as well as the company acumen to produce and perform a service method.

Financial advisors spend a long time daily viewing or checking out market information on tv, online, or in trade publications. Financial advisors with Edward Jones have the benefit of home workplace study teams that aid them remain up to date on stock recommendations, shared fund management, and more. Spending is not a "set it and forget it" task.

Financial experts must schedule time each week to fulfill new individuals and catch up with the people in their ball. Edward Jones economic consultants are lucky the home workplace does the hefty training for them.

Examine This Report about Clark Wealth Partners

Proceeding education and learning is a required component of keeping a monetary consultant permit (financial advisors Ofallon illinois). Edward Jones financial experts are urged to pursue additional training to widen their understanding and abilities. Commitment to education and learning protected Edward Jones the No. 17 area on the 2024 Educating APEX Honors list by Training publication. It's additionally an excellent idea for financial experts to go to sector conferences.